Wall Street Says Sell. My Proprietary Model Says +96% Upside. Who Is Wrong

If you bought Novo Nordisk (NVO) in 2025, I apologize. It was arguably the most frustrating hold in the healthcare sector. The stock was a masterclass in wealth destruction for late entrants: the "unstoppable" growth narrative collided with the reality of the disappointing CagriSema Phase 3 readouts in December and the shock departure of CEO Lars Fruergaard Jørgensen last May.

Wall Street has left this stock for dead. Sentiment is not just low; it is broken. Analysts are slashing targets, citing "Obesity Fatigue" and "Efficacy Defeat" against Eli Lilly.

That is exactly why I am buying.

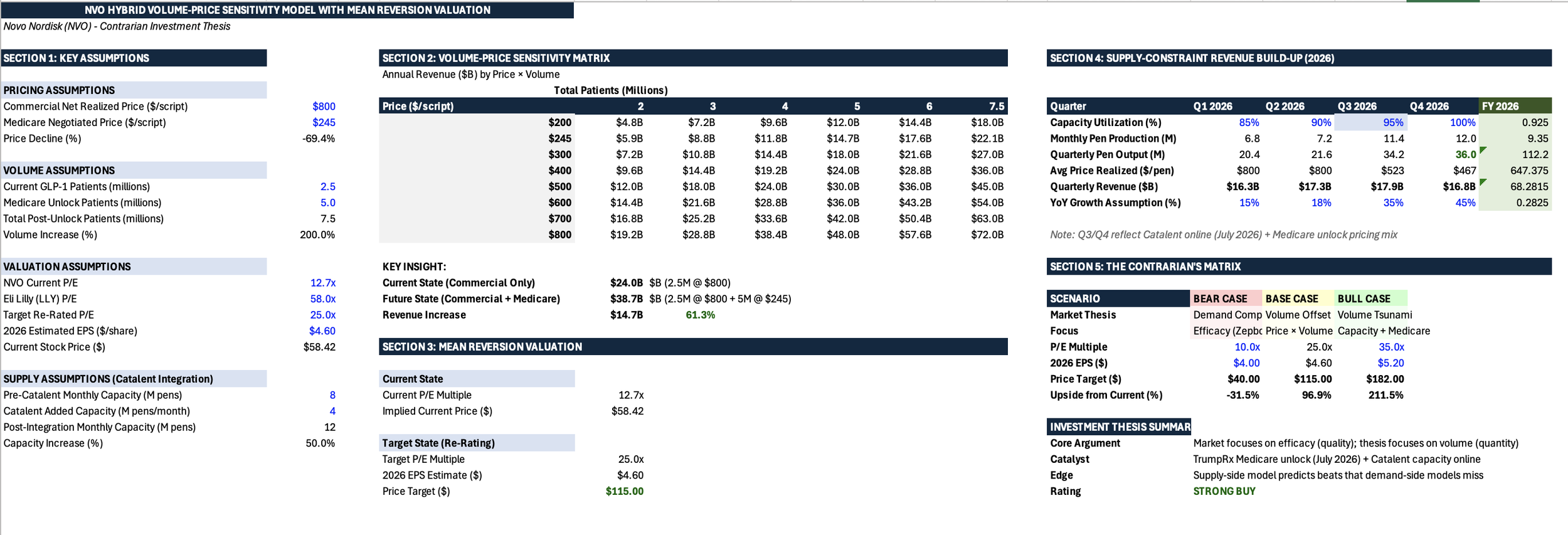

The market is fixating on the wrong data points. They are looking at efficacy wars (where Lilly’s Zepbound is currently winning) while ignoring the volume tsunami about to hit. They see margin compression; I see total profit expansion. I have run a proprietary Hybrid Volume-Price Sensitivity Model, and the math is undeniable: the "Volume Tsunami" washes away the margin concerns.

Here is the deep-dive analysis on why I predict NVO will be the top turnaround story of Q1 2026.

The Valuation Gap: A Historic Dislocation

Let’s address the elephant in the room first: The CagriSema results released on December 18 were a letdown. The drug demonstrated 22.7% weight loss. While objectively a medical marvel, it missed the 25% "whisper number" needed to decisively beat Eli Lilly’s Zepbound.

The stock flushed on that news. But the selling has become irrational. Look at where we are now. At 12.7x forward earnings, Novo Nordisk is trading at a valuation reserved for stagnant legacy pharma companies facing patent cliffs.

Meanwhile, Eli Lilly (LLY) trades at 58.0x, pricing in absolute perfection. The market is effectively saying Lilly will capture 100% of the future growth and Novo will capture 0%. This is a duopoly, not a "winner take all" market.

We do not need NVO to trade at 58x to make money. We only need a mean reversion to a conservative 25.0x—less than half of Lilly's multiple. My model puts the Base Case Price Target at $115.00, representing 96.9% upside from current levels.

[Chart: P/E Ratio Divergence NVO vs LLY (Jan 2025 - Jan 2026) showing NVO crashing to 12.7x while LLY rises to 58x]

The "TrumpRx" Volume Catalyst: The Math Behind the Unlock

While investors were crying over CagriSema, they missed the most critical regulatory shift of the decade: the "TrumpRx" initiative, announced by the White House in November 2025, which explicitly brings GLP-1 coverage to Medicare Part D beneficiaries starting July 2026.

Critics are selling NVO because they fear the -69.4% price crash coming with the negotiated Medicare price of **$245/script** (down from ~$800 commercial). They see the price erosion, but my model proves they are missing the scale of the volume offset.

The Core Equation: Volume × $245 >> Price Erosion The fear is that revenue will shrink. My model isolates the two distinct patient cohorts to prove otherwise:

Current State (Commercial Only): Novo currently services ~2.5 million patients at a high net price (~$800/script).

Implied Annual Revenue Base: $24.0 Billion

Future State (Commercial + Medicare Unlock): The "Medicare Unlock" adds a fresh 5.0 million patients.

Even at the lower negotiated price of $245, this new cohort generates **$14.7 Billion** in incremental revenue.

Total Future Revenue: $38.7 Billion

The Verdict: We are looking at a 61.3% revenue increase purely from the volume unlock. The "Bear Case" assumes we lose commercial pricing power, but the "Base Case" proves that simply layering on the Medicare volume—even at a discount—is massively accretive.

The "Good Enough" Thesis

Why will Medicare patients choose Wegovy (Novo) over Zepbound (Lilly)? Because for a broad population rollout, payers prioritize access over marginal efficacy.

Zepbound may cause 2% more weight loss, but Novo has the formulary incumbency. For a Medicare patient paying a flat $50 copay, the clinical difference between 22% weight loss and 24% weight loss is negligible. The "Good Enough" product with the best supply chain wins the volume war. And right now, Novo is winning the supply war.

The Supply Reality: Capacity is King

None of this matters if you can't build the pens. For three years, Novo’s growth was capped not by demand, but by how many pens they could fill. That era ended last month.

On December 18, 2024, Novo officially completed the integration of the Catalent manufacturing sites. My supply-side model forecasts the quarterly ramp-up following this integration:

Pre-Integration Capacity: ~8 Million pens/month.

Post-Integration Capacity: 12 Million pens/month (+50%).

Quarterly Ramp-Up Forecast:

Q1 2026: 85% Capacity Utilization (Systems testing)

Q2 2026: 90% Capacity Utilization

Q3 2026: 95% Capacity Utilization (Medicare Unlock Begins)

Q4 2026: 100% Capacity Utilization (Full Output)

By Q4 2026, I project monthly pen output hitting 12.0 million. This supply unlock is perfectly timed to meet the Q3 Medicare demand surge. While average price realization drops to ~$467 in Q4 due to the mix shift, the sheer quantity of units sold keeps the quarterly revenue near **$16.8B—$17.9B**, a massive step up from 2025 levels.

The J.P. Morgan Catalyst (Jan 13)

Next Tuesday, new CEO Mike Doustdar will take the stage at the J.P. Morgan Healthcare Conference in San Francisco.

The Street expects him to be defensive, apologizing for the CagriSema miss. I predict he will be offensive. I expect him to:

Pivot the narrative to Amycretin (oral)—which showed stellar Phase 2 data in November.

Outline this exact "Volume over Value" strategy regarding Medicare.

Confirm the Q1 capacity ramp-up from the Catalent sites.

Any positive guidance on capacity will force a short squeeze.

Investment Verdict

The spreadsheet doesn't lie. The $245 Medicare price isn't a "revenue cliff"—it's a volume bridge to a $38B+ annual run rate. The hate has gone too far, the valuation is too cheap, and the supply is finally online.

Rating: STRONG BUY Base Case Price Target: $115.00 (+96.9%) Bull Case Price Target: $182.00 (+211.5%)