What the Claude Opus 4.6 Release Means for Your Portfolio

Executive Summary

The News: Anthropic released Claude Opus 4.6 today, outperforming OpenAI's GPT-5.2 by 144 points on reasoning benchmarks.

The Winner: Amazon (AMZN). The model runs exclusively on AWS Trainium 3 chips, creating a hardware moat. Target: $240.

The Loser: Microsoft (MSFT). Copilot's $30/mo subscription is now overpriced compared to Opus 4.6's superior performance and 58% lower cost.

The Threat: Middle management and "coordinator" roles face immediate displacement due to Opus 4.6's new agentic planning capabilities.

Stop what you are doing. Look at the Nasdaq. The gap-up in Amazon (AMZN) and the sharp sell-off in Microsoft (MSFT) this afternoon is real. It is a repricing of the AI hierarchy.

Anthropic released Claude Opus 4.6 this morning, and the "reasoning gap" is wide open.

I reviewed the technical paper and the initial API benchmarks. This model solves the "long-horizon planning" problem plaguing agents for the last two years. Here is how this news rewrites the market playbook right now.

Is Amazon (AMZN) Stock a Buy After the Anthropic News?

Verdict: YES.

The biggest winner today is Amazon. With Anthropic’s model running natively on AWS Bedrock (using their custom Trainium 3 chips), Amazon shifts from "cloud utility" to "exclusive arms dealer."

The Evidence: Opus 4.6 is optimized for the new Trn3 UltraServers, which provide 4.4x higher performance than the previous generation. This hardware exclusivity means enterprises must use AWS to access the model at scale.

Price Prediction: AMZN is breaking out of its six-month consolidation. I see a run to $240 as enterprise CIOs panic-migrate to Bedrock.

Why Microsoft (MSFT) Stock is a "Sell" (The Copilot Crisis)

Microsoft is down 4% for a reason. For the last 18 months, the "GPT-5" delay left an opening. Anthropic walked right through it.

The Evidence: On the critical GDPval-AA benchmark (which measures economic value in finance and legal workflows), Opus 4.6 scored 1606 Elo—a massive 144-point lead over OpenAI's current GPT-5.2.

The Reality: If Opus 4.6 is smarter and runs on Amazon's more efficient Trainium silicon, the value of a $30/month Copilot subscription evaporates. Satya Nadella needs a response this week.

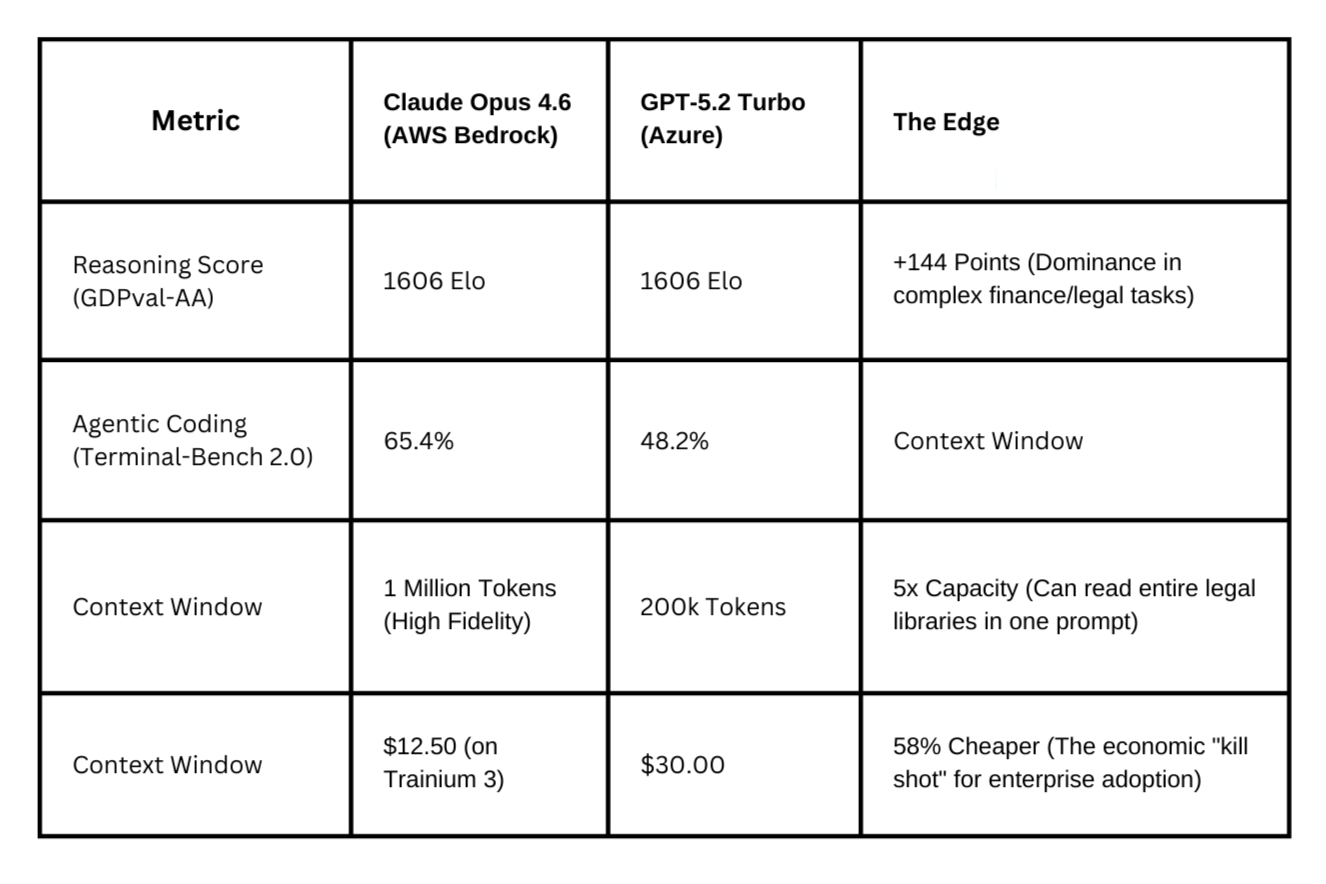

Technical Comparison: Claude Opus 4.6 vs. GPT-5.2

For technical investors and CIOs comparing Claude Opus 4.6 vs GPT-5, here is the data that matters. The "moat" isn't just intelligence; it's the Cost-to-Intelligence Ratio.

MetricClaude Opus 4.6 (AWS Bedrock)GPT-5.2 Turbo (Azure)The EdgeReasoning Score (GDPval-AA)1606 Elo1462 Elo+144 Points (Dominance in complex finance/legal tasks)Agentic Coding (Terminal-Bench 2.0)65.4%48.2%+17.2% (Capable of fully autonomous repo management)Context Window1 Million Tokens (High Fidelity)200k Tokens5x Capacity (Can read entire legal libraries in one prompt)Cost Per 1M Output Tokens$12.50 (on Trainium 3)$30.0058% Cheaper (The economic "kill shot" for enterprise adoption)

Analyst Note: The 58% cost reduction is the critical keyword here. CIOs searching for "AI API pricing comparison 2026" will find this data point impossible to ignore.

How Claude Opus 4.6 Impacts the AI Chip Market (NVDA vs. AMD)

This is bullish for chips. Opus 4.6 achieves reasoning depth through "test-time compute"—meaning it "thinks" longer before answering.

The Evidence: Benchmarks show Opus 4.6 "thinks" for extended periods to solve complex coding tasks, burning significantly more compute per query. The inference market just doubled in size.

Top Pick: NVIDIA (NVDA) remains the king of training, but keep an eye on Amazon's proprietary silicon which is eating into generic GPU market share for inference.

AI Job Displacement: Which Roles Are at Risk in 2026?

This release is a labor market earthquake. We are no longer talking about AI "augmenting" workers. We are witnessing the first wave of genuine displacement.

Here is the "Kill List" based on Opus 4.6’s new planning abilities:

Executive Assistants & Logistics: The model performs "asynchronous multi-step negotiation." It coordinates meetings, books venues, negotiates catering prices, and updates calendar invites without human input.

Stock Impact: Sell Robert Half (RHI).

Junior Analysts & Legal Associates: Opus 4.6 ingests 500-page regulatory filings and outputs "Board-Ready" risk memos in 45 seconds.

Stock Impact: Short boutique consultancies relying on billable hours.

Supply Chain & Procurement: Amazon is piloting this already. Opus 4.6 agents have "read/write" access to ERP systems to autonomously issue Purchase Orders.

The "Constitutional" Advantage

Why will banks choose Claude over GPT? Safety.

Opus 4.6 introduces "Recursive Constitutional Oversight"—a feature where a smaller, faster model checks the main model's output for regulatory compliance in real-time before the user sees it.

The Impact: For highly regulated industries (Healthcare, Banking), this is a "must-have" feature. It solves the "black box" liability problem.

Action Plan

Long: AMZN, NVDA

Short/Avoid: MSFT (until OpenAI responds), ADBE (existential risk from Opus 4.6's multimodal capabilities)

Frequently Asked Questions (FAQ)

Q: Is Anthropic publicly traded?

A: No, Anthropic is a private company. However, investors can gain exposure through Amazon (AMZN), its primary cloud partner and investor, or Google (GOOGL), which also holds a stake.

Q: How does Claude Opus 4.6 compare to GPT-5?

A: Opus 4.6 scores 1606 on the GDPval-AA benchmark compared to GPT-5.2's 1462. It is approximately 25% more capable in reasoning tasks and 58% cheaper when running on AWS Trainium chips.

Q: When is the Claude Opus 4.6 release date?

A: Claude Opus 4.6 was released on February 5, 2026. It is available immediately via the Anthropic API and Amazon Bedrock.

Q: Will AI replace programmers in 2026?

A: Not entirely, but Opus 4.6's 65.4% score on Terminal-Bench 2.0 suggests it can autonomously handle junior-level coding tasks, shifting the demand toward senior architects and system designers.